Les meilleurs produits

à base de CBD

Bons plans et astuces pour acheter du CBD

On en parle sur le Blog

Le CBD est un nouvel ingrédient alimentaire non psychoactif qui peut apporter des bienfaits pour le bien-être. Le CBD peut être dérivé du chanvre ou du cannabis et est disponible dans une variété de produits.

- Decouvrez les varietes rares : Graines de CBD pour les collectionneurs

- Faut-il avaler la fumée de la cigarette ? Une transition vers la cigarette électronique

- La fleur de CBD : une découverte prometteuse pour le bien-être

- Découvrons l’huile de CBD: Mythes et Réalités

- Ou est-il possible de trouver du CBD ?

- Comment la cigarette électronique peut vous aider à arrêter de fumer en toute sécurité

- Le guide pratique a propos des fleurs CBD

- Quels sont les bienfaits approuves du CBD ?

- Où trouver du CBD puissant ?

- Comment donner du CBD à son chat ?

- Quel est le prix du CBD en bureau de tabac ?

- Quelles précautions prendre avant de donner du CBD à son animal ?

- Est-ce que le CBD se vend en pharmacie ?

- Quel CBD pour maigrir ?

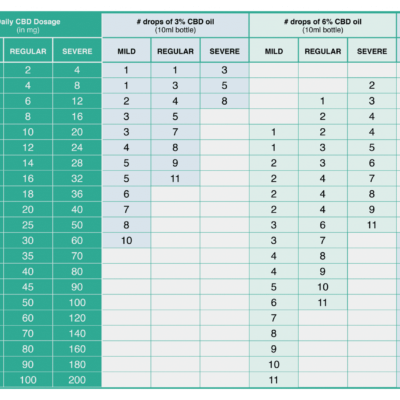

- Quelle huile de CBD pour les douleurs ?

- Quel type de CBD pour fumer ?

- Quel CBD pour dormir ?

- Comment se faire rembourser le CBD ?

- Quel CBD fait le plus d’effet ?

- Quel est le prix du CBD ?

- Où faire un achat de fleur de CBD ?

- Quel CBD pour animaux ?

- Comment avoir une prescription de CBD ?

- Quelles sont les meilleures fleurs de CBD ?

- Où commander les meilleures fleurs de CBD ?

- Où trouver de l’huile de CBD en France ?

- Est-ce que le CBD est remboursé par la sécurité sociale ?

- Quel CBD pour chat ?

- Est-ce que le CBD se vend en pharmacie ?

- Quel est le meilleur site de CBD ?